Fermi America, which is developing a private grid campus designed to power the growing demands of artificial intelligence (AI) in Amarillo, Texas, has filed a Registration Statement on Form S-11 with the US Securities & Exchange Commission (SEC) relating to the proposed initial public offering (IPO) of its common stock. The number of shares to be offered and the price range for the proposed offering have not yet been determined. Fermi intends to list its common stock on the Nasdaq Global Select Market under the symbol FRMI.

UBS Investment Bank, Cantor and Mizuho will act as joint lead book-running managers for the proposed offering. Macquarie Capital, Stifel and Truist Securities will act as additional book-running managers.

A registration statement relating to these securities has been filed with SEC. The securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becoming effective. Fermi said any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act.

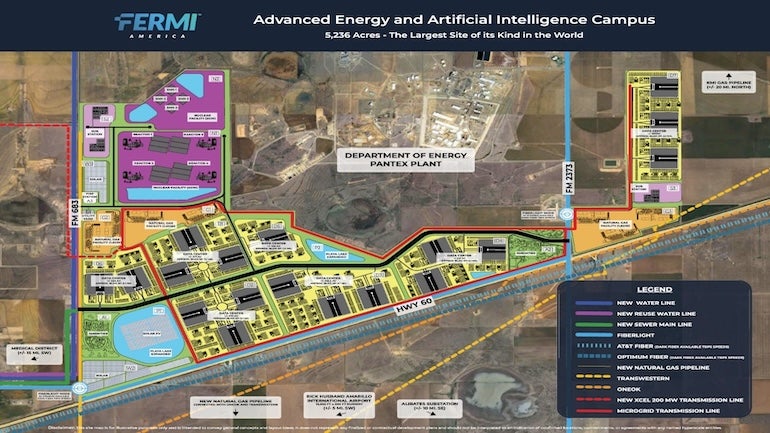

Fermi America, co-founded by former US Energy Secretary Rick Perry and former Co-Managing Partner of Quantum Energy, Toby Neugebauer, is developing Project Matador, a planned 11 GWe hyperscale data centre complex in partnership with the Texas Tech University System, with the campus set to be built on land at Texas Tech University.

Fermi plans to use a range of on-site power sources, including natural gas, solar, wind, and nuclear energy. In July, the company acquired more than 600 MWe of natural gas generation assets across two deals. The acquired assets include nine natural gas turbines, which the company stated will support its goal of delivering 1 GWe of non-nuclear power at the site by 2026.

Natural gas will be the primary power source in the short term with nuclear eventually becoming the primary supplier of energy to the site. Fermi plans to deploy four Westinghouse AP1000 reactors at the campus, and in an attempt to streamline the permitting process, Fermi has partnered with Westinghouse to finalise the Combined Operating Licence Application (COLA) with the Nuclear Regulatory Commission (NRC).

NRC’s acceptance of the COLA is the first application the regulator has received for a gigawatt-scale light water reactor since 2009. The next regulatory step for Fermi America will be the submission of the site-specific information needed for part three of the COLA. The NRC’s schedule sets 28 February 2026, as the deadline for an environmental impact statement and 31 December 2026, for the final submission.

However, concerns remain over whether Fermi will be able to deploy the reactors on time and within budget. The last set of AP1000 units installed in the US was at the Vogtle nuclear plant in 2023, coming in $17bn over budget and more than seven years behind schedule.

Fermi America currently plans to deploy its first AP1000 in 2032, with the next three coming in 2034, 2035, and 2036. This somewhat ambitious timeline will depend on many things going right for the company, from speedy regulatory approval to significant funding.

Fermi has also signed two memoranda of understanding with South Korean firms Hyundai and Doosan Enerbility to support the deployment of the nuclear reactors on the site. Westinghouse is not directly involved in the construction of any of its AP1000 projects, preferring to use contractors.

Project Matador is still in its very early stages of development and is currently undertaking geotechnical work. Earlier in September, Fermi raised $100m as part of a Series C equity funding round, led by Macquarie Group. Fermi also secured a $250m senior loan facility, funded solely by Macquarie’s commodities and global markets business, with $100m drawn at close.

Fermi America’s registration statement with the SEC provides a new information and updates on the company’s plans. Aside from reaffirming its timetable for reactor deployment, the statement also emphasises the company’s current focus on procuring long-lead-time equipment and its plans to rely on the highly experienced workforce at the nearby Pantex nuclear weapons plant, which is also in Amarillo.

Project Matador is “designed to include approximately 6.0 GWe of nuclear capacity across two nuclear islands,” the company said. It expects the final 2 GWe to come from small modular reactors (SMRs) for which is has yet to select a supplier. However, the MOU signed with Doosan Enerbility includes evaluation of potential SMR options.

According to the AI-Energy Nexus newsletter: “Usually, before filing for an IPO, a large data centre company would need to have upfront capital, physical assets, and long-term customer contracts to demonstrate a path to cash flow. Fermi isn’t quite there yet.” The filing shows that Fermi plans to rely on the IPO proceeds, future project financing, and potential loans (including from the Department of Energy) to fund the projects – none of which it has yet secured.

Meanwhile, the SEC filing accompanying the IPO includes a long list of potential risks and factors that could change the path to project development, including the fact that “the market for generating nuclear power is not yet established and may not achieve the growth potential we expect or may grow more slowly than expected”.

As the company itself summarises, Fermi is “a development-stage company with no operating history or historical revenue, and we face execution risk across all major components of our business.”

<!– –>